What you MUST know before taking a loan

Since the loan tenure is directly related to the Equated Monthly Installment, let's look at this concept first.

After you take a loan, you will have to repay part of it every single month. This is irrespective of whether it is a vehicle loan, home loan, personal loan or education loan. Repayment is always done on a monthly basis.

This amount that you repay every month is referred to as the Equated Monthly Installment.

The EMI stays constant

There are two parts to loan repayment -- the principal amount and the interest payment.

Interestingly, the EMI, which is generally a fixed amount, is an unequal combination of interest repayment and principal repayment.

Sure, there are exceptions. You could also ask for an EMI that changes over the years such as an ascending EMI or descending EMI (which means your EMI increases or reduces over the years).

Let's work it out with a constant EMI.

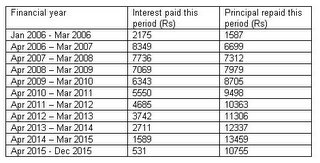

Loan amount: Rs 1,00,000

Rate of interest: 8.75% per annum

Tenure: 10 calendar years

EMI: Rs 1,254

Let's say that the EMI payments start from January 1, 2006.

So while the EMI remained constant every month, at the start of repayment, you were paying a higher component of interest and towards the end, a higher component of principal.

The EMI is affected by tenure

The EMI may be constant but what you need to look out for is the tenure. Let's work it out with some figures.

Interest rate = 9% per annum

Loan amount = Rs 10,00,000

Tenure = 5 years / 60 months

EMI = Rs 21,424

Total amount you will pay over the 5 years = Rs 12,85,440

Interest rate = 9% per annum

Loan amount = Rs 10,00,000

Tenure = 8 years / 96 months

EMI = Rs 15,056

Total amount you will pay over the 8 years = Rs 14,45,376

Interest rate = 9% per annum

Loan amount = Rs 10,00,000

Tenure = 3 years / 36 months

EMI = Rs 32,921

Total amount you will pay over the 3 years = Rs 11,85,156

The lesser the tenure, the higher the EMI.

The lesser the tenure, the less you eventually pay to the financier.

Does that mean you should take a short tenure loan and a higher EMI?

Broadly speaking, yes. However, you will have to look at a number of factors before you reach that decision.

1. Tax benefits

If you are getting tax benefits, as you would on a home loan or education loan, then you may want to service the loan for a few years. If you are getting no tax benefits, you should look at repaying it quickly.

2. Comfort level

You may want to pay back the loan as soon as possible, but you may not be able to afford a higher EMI. In this is the case, you may have to opt for a loan with a longer tenure so you will have more time to pay it off.

3. Salary increases

If you are in a job where you foresee high increments every year, you can opt for a shorter tenure. Let's say you are paying back Rs 10,000 a month and you are earning Rs 30,000 a month. Let's further assume you are going to get a hike to Rs 38,000 per month.

Now the EMI stays constant but you are earning much more so it does not pinch as much. Opting for a shorter tenure and a high EMI makes sense if you foresee rapid or substantial increments.

4. Interest rate

If the loan has a high interest rate, it is best to pay it back as soon as possible. On your home loan, you would have got a very competitive rate. But you will be paying a high rate of interest on your personal loan. In such instances, even if it means living on tight budget, opt for a higher EMI.

Finally, you will have to work out a deal you are comfortable with. For instance, let's say your friend has taken a loan and is servicing an EMI of Rs 4,500. You may want to take the same deal.

If he is earning Rs 15,000, the EMI would be 30% of his income. But, if you are earning Rs 30,000 per month, the EMI would be just 15% of your income. Maybe you could take a higher EMI if you can afford it.

So don't go by absolute figures, see what percentage of your earnings is going towards loan repayments. Only then take a call.

0 Comments:

Post a Comment

<< Home