The safest investment plans

Simply put, assured return schemes are investments wherein the returns are fixed. Hence, the investor knows with certainty the amount she will receive on maturity. Conventionally, schemes of the assured return variety (i.e. fixed deposits and small savings schemes) have held a lot of appeal for women.

The popularity of these schemes can perhaps be traced to their 'safety element,' i.e. the returns are assured. Broadly speaking, women tend to be rather thrifty in their spending habits; the same attitude perhaps spills over into their investments as well.

An overbearing factor (especially pertinent to the present generation of investors) is that we have been conditioned to believe that taking on any degree of risk in investments is sacrilegious. For example market-linked avenues like equities were equated to gambling.

Not too long ago, the choices available to retail investors were limited. As a result any surplus amount at the investors' disposal (virtually by default) made way towards the local bank in the form of a fixed deposit; alternately the funds were invested in the small savings segment, i.e. National Savings Certificate, Kisan Vikas Patra (KVP) or the Public Provident Fund (PPF).

Another vital (yet underrated) factor is "convenience of investing". This is an area where avenues like chit funds and private deposits score over their counterparts like bank fixed deposits or small savings schemes, especially among women investors. Neighborhood jewellery stores and garment outlets among others often double up as 'asset management companies.'

They accept deposits, run chit funds for their regular clientele. The shop is a known entity with which women have transacted for ages and a certain degree of trust exists. For the investor (read women with shopping on their mind) there lies the opportunity to do shopping and investing simultaneously! Seems perfect, doesn't it?

In our view this scenario is anything but ideal. Investors must first determine the reason for investing in an assured return scheme. Getting invested in the abovementioned avenues simply because you have always done so or because it is convenient don't qualify as good reasons.

If the driving point is to make a safe investment, i.e. invest in a low risk instrument, then what we are seeing here is a contradiction.

Chit funds and private deposits are unsecured by nature; as a result their risk profile is disproportionately high.

How to invest?

There should be no ambiguity in the investors' mind regarding the motive behind investing in assured return schemes. In fact, this should be the starting point for the investment process.

If the intention is to participate in a low risk instrument, investors should give risky avenues like company/private deposits a miss. Safety of returns should be given top priority even if it means compromising on the returns.

There is also a need to understand the dynamics of investing in an assured return scheme. Instruments like fixed deposits and NSC are among the worst hit ones in an inflationary environment.

For example, if a fixed deposit scheme offers a return of 6% per annum and the prevailing inflation rate is 4%, the effective return for the investor is 2%. If the inflation rate were to rise to 5%, the investor's effective return stands further truncated to just 1%. The fixed returns from the scheme can become a bane for investors.

Also liquidity, i.e. the ease with which these investments can be converted into cash should be considered. Often premature encashment of assured return schemes entails bearing a penalty. Investors should be aware of the same before any investment decision is made.

Despite some of the seemingly unflattering characteristics, the importance of having assured return schemes in one's portfolio from the diversification perspective cannot be overstated.

Assured return schemes form a vital component in every investor's asset allocation.

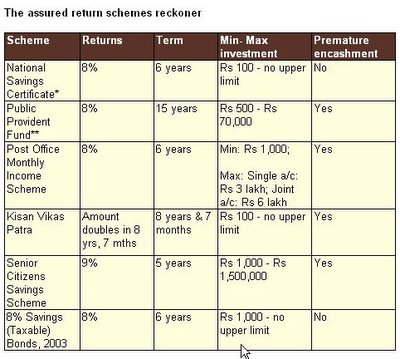

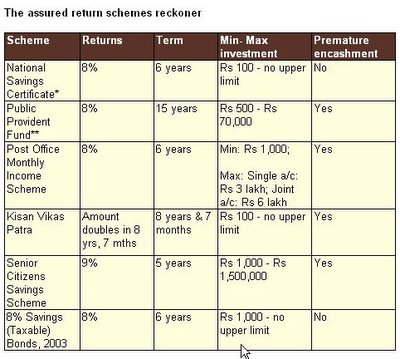

(*Tax benefit under Section 80C; **Tax benefit under Sections 80C and 10).

Where to invest?

Having discussed the various principles governing investments in assured return schemes, now let us examine some of the options available to investors.

1. Fixed Deposits

Investors should select fixed deposits which offer the highest degree of safety i.e. ones with an "AAA" or similar rating. Company deposits or similar unsecured ones should be treated as a strict no-no. Likewise, variable rate deposits can be considered for the purpose of investment.

As the name suggests, the coupon rate (interest rate offered) on these deposits is subject to change based on changes in some benchmark interest rate. Variable rate deposits can prove to be of high utility in a rising interest rate scenario by safeguarding the investors' effective returns.

2. Small Savings Schemes

The small savings segment offers investors a wide range of options to choose from, each with a unique set of benefits. For examples investments in NSC are eligible for deduction under Section 80C; on the flipside, they score very poorly on the liquidity front.

Post Office Monthly Income Scheme (POMIS) can help investors earn assured returns on a monthly basis, but the scheme is devoid of any tax benefits. Public Provident Fund (PPF) runs over a 15-year horizon and can help investors plan for long-term events like children's education; however returns on the scheme are subject to change. The tax sops in some of the schemes will especially appeal to working women.

The assured returns segment undeniably can add significant value to your portfolio. It is pertinent from the investors' perspective to make an informed choice and select a scheme best suited to her needs.

The popularity of these schemes can perhaps be traced to their 'safety element,' i.e. the returns are assured. Broadly speaking, women tend to be rather thrifty in their spending habits; the same attitude perhaps spills over into their investments as well.

An overbearing factor (especially pertinent to the present generation of investors) is that we have been conditioned to believe that taking on any degree of risk in investments is sacrilegious. For example market-linked avenues like equities were equated to gambling.

Not too long ago, the choices available to retail investors were limited. As a result any surplus amount at the investors' disposal (virtually by default) made way towards the local bank in the form of a fixed deposit; alternately the funds were invested in the small savings segment, i.e. National Savings Certificate, Kisan Vikas Patra (KVP) or the Public Provident Fund (PPF).

Another vital (yet underrated) factor is "convenience of investing". This is an area where avenues like chit funds and private deposits score over their counterparts like bank fixed deposits or small savings schemes, especially among women investors. Neighborhood jewellery stores and garment outlets among others often double up as 'asset management companies.'

They accept deposits, run chit funds for their regular clientele. The shop is a known entity with which women have transacted for ages and a certain degree of trust exists. For the investor (read women with shopping on their mind) there lies the opportunity to do shopping and investing simultaneously! Seems perfect, doesn't it?

In our view this scenario is anything but ideal. Investors must first determine the reason for investing in an assured return scheme. Getting invested in the abovementioned avenues simply because you have always done so or because it is convenient don't qualify as good reasons.

If the driving point is to make a safe investment, i.e. invest in a low risk instrument, then what we are seeing here is a contradiction.

Chit funds and private deposits are unsecured by nature; as a result their risk profile is disproportionately high.

How to invest?

There should be no ambiguity in the investors' mind regarding the motive behind investing in assured return schemes. In fact, this should be the starting point for the investment process.

If the intention is to participate in a low risk instrument, investors should give risky avenues like company/private deposits a miss. Safety of returns should be given top priority even if it means compromising on the returns.

There is also a need to understand the dynamics of investing in an assured return scheme. Instruments like fixed deposits and NSC are among the worst hit ones in an inflationary environment.

For example, if a fixed deposit scheme offers a return of 6% per annum and the prevailing inflation rate is 4%, the effective return for the investor is 2%. If the inflation rate were to rise to 5%, the investor's effective return stands further truncated to just 1%. The fixed returns from the scheme can become a bane for investors.

Also liquidity, i.e. the ease with which these investments can be converted into cash should be considered. Often premature encashment of assured return schemes entails bearing a penalty. Investors should be aware of the same before any investment decision is made.

Despite some of the seemingly unflattering characteristics, the importance of having assured return schemes in one's portfolio from the diversification perspective cannot be overstated.

Assured return schemes form a vital component in every investor's asset allocation.

(*Tax benefit under Section 80C; **Tax benefit under Sections 80C and 10).

Where to invest?

Having discussed the various principles governing investments in assured return schemes, now let us examine some of the options available to investors.

1. Fixed Deposits

Investors should select fixed deposits which offer the highest degree of safety i.e. ones with an "AAA" or similar rating. Company deposits or similar unsecured ones should be treated as a strict no-no. Likewise, variable rate deposits can be considered for the purpose of investment.

As the name suggests, the coupon rate (interest rate offered) on these deposits is subject to change based on changes in some benchmark interest rate. Variable rate deposits can prove to be of high utility in a rising interest rate scenario by safeguarding the investors' effective returns.

2. Small Savings Schemes

The small savings segment offers investors a wide range of options to choose from, each with a unique set of benefits. For examples investments in NSC are eligible for deduction under Section 80C; on the flipside, they score very poorly on the liquidity front.

Post Office Monthly Income Scheme (POMIS) can help investors earn assured returns on a monthly basis, but the scheme is devoid of any tax benefits. Public Provident Fund (PPF) runs over a 15-year horizon and can help investors plan for long-term events like children's education; however returns on the scheme are subject to change. The tax sops in some of the schemes will especially appeal to working women.

The assured returns segment undeniably can add significant value to your portfolio. It is pertinent from the investors' perspective to make an informed choice and select a scheme best suited to her needs.

0 Comments:

Post a Comment

<< Home